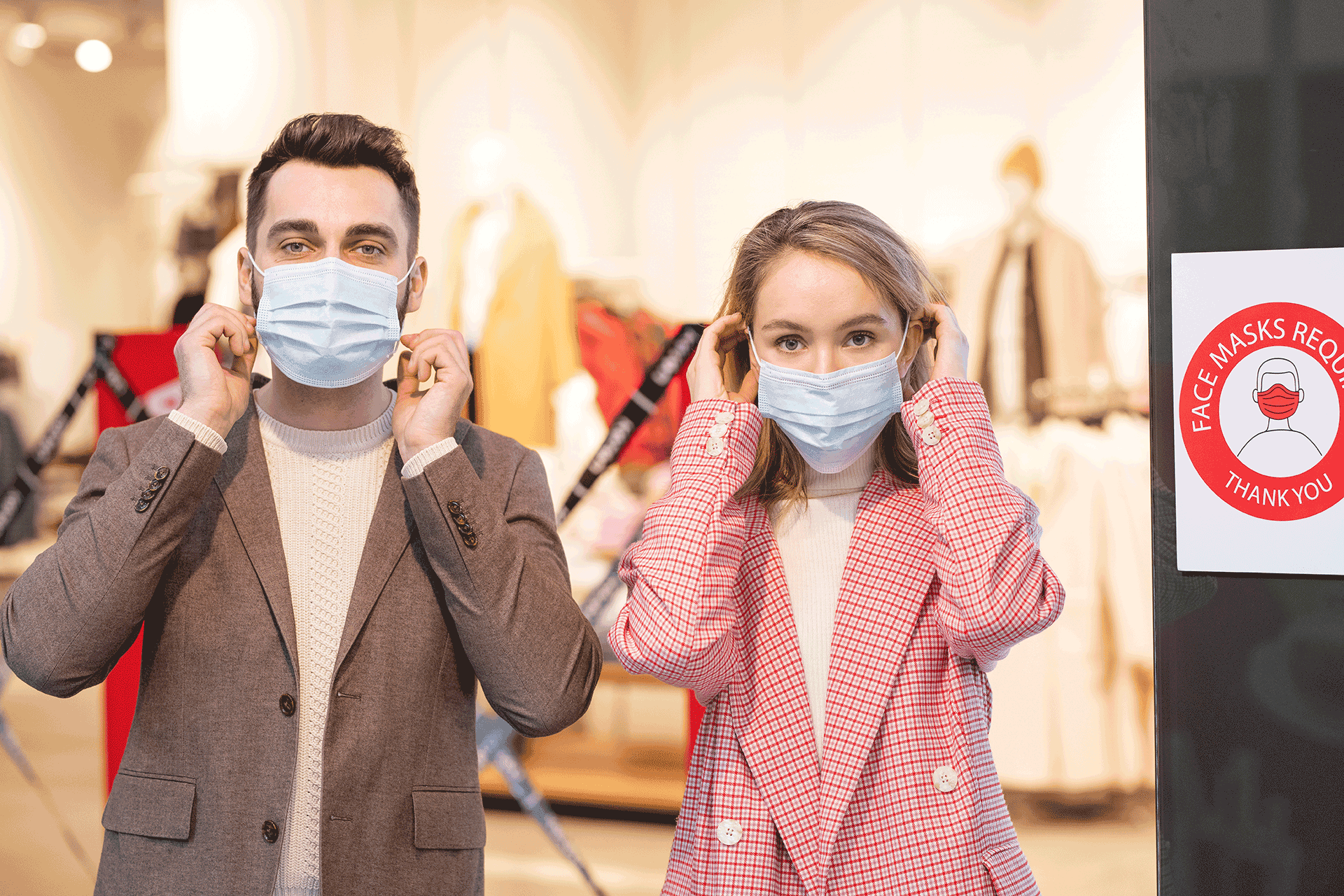

Impacted by COVID-19? 10 Tips to Keep Business Strong — Even From Home

No matter how big or how small your business is, all businesses are facing unprecedented disruptions due to the spread of the coronavirus, or COVID-19. There are actions and strategies small businesses can employ to help them get through these unusual times. Here are 10 tips to keep your business thriving, for business owners like you, during the COVID-19 pandemic.

1. Negotiate and Adjust Your Lease Agreement

“An effective way a company can mitigate the effect of the coronavirus on the business is to notify the landlord that you want to terminate the business lease agreement. The expense of continued rent for an office that is not even being used by the business is the most important expense for a business to manage in these unprecedented times,” said David Reischer, business law attorney and CEO of LegalAdvice.com . “It is critical to cut business expenses and high rents for [an] office that can no longer even be used will ultimately lead to almost certain bankruptcy. If it is no longer possible to go in the office then immediately notify the landlord of the intention to terminate future business in the office even though doing so may be a breach of the agreement. New laws may allow for the lease agreement to be voided in recognition that the contract cannot to be performed and has been frustrated and made impossible by natural events. The coronavirus, and the governments reaction to the virus now makes the agreement null and void if the consequence of honoring the agreement would be the bankruptcy of the business. A business will not be able to use the commercial space as originally intended when the contract was signed because of significant changed circumstances. A business should also check their lease agreement, insurance regarding the inclusion of a 'force majeure' clause, which is sometimes a clause included in contracts to remove liability for natural and unavoidable catastrophes that disrupt the expected course of events and limits contract parties from fulfilling obligations.”

2. Build Brand Awareness by Joining the Conversation

“Participate in the conversation online to build brand awareness and reputation while your doors are closed. For instance, there are hashtags about coronavirus every day on Twitter that you could participate in — not with salesy messages, but instead with helpful, value-adding content,” said Jayson DeMers, CEO of EmailAnalytics . “Establish your brand as a member of the global community coming together to fight this virus and when things start to return to normal, you might find that a lot of people remember you and pay you a visit.” Also: 12 Ways to Support Businesses Struggling Due to Coronavirus Closures

3 Get Innovative and More Flexible

“For the community, we introduced free online eyewear consultations via video chat to discourage in-person consultations and visits to the retail store. We are accommodating one-day rush orders and processing orders in hours. We can help anyone find their prescription just by sending us their current glasses — whether they're broken or not — so they don't have to go out and visit an optometrist,” said Alexandra Tanasa of Vint & York . “We make shipping and returns free for any order value, and for any type of order, whether single vision or custom lenses. For custom lens orders, we give the possibility to order the frame before you put in the lens order, so customers feel safe before spending their money on something that would turn out non-returnable. We, of course, doubled down on cleaning and disinfecting the packing facility and our optical lab.”

4. Stay on Top of Cash Flow

“Cash flow — this is incredibly important for small businesses,” said Kevin Gould, founder and CEO of Kombo Ventures . “Look at your bank balance and look at all of your current and future payables. Look at all of your accounts payable. Figure out what has to be paid, what can be pushed. Your credit cards — many credit card companies are giving temporary reprieves. Call the credit card company and ask for net 60 or 90 terms; some will give it right now. Merchant line of credits — if you have been with [a credit card issuer] for a while, call them and see if they will extend a merchant line of credit. Small business loan — for some businesses if you have two years of history you may qualify.”

5. Find Opportunity Where Others Are Cutting Costs

“From a digital marketing perspective, I think there are opportunities with paid advertising such as Google Ads. One of the first instincts many businesses will have is to shut down all marketing efforts, especially Google Ads, which is an auction where the top spot essentially goes to the highest bidder with the most relevant ad,” said Geoff Hoesch, CEO of Dragonfly Digital Marketing . “With less competition for clicks, cost per click should go down, as should cost per acquisition. If you do end up capitalizing on this, make sure you use exact match phrases to get precisely the traffic you want. A lean, finely tuned campaign can help you pick up some of the remaining traffic that’s out there.” See: Rejected for a Business Loan? 5 Next Steps to Take

6. Rely on Digital and Online Solutions More Than Ever

"In order to run a law firm that can operate remotely, number one, you have to have case management software that is fully functional from a remote basis. It needs to be web-based so you can access documents related to a case, and work on the case as if you were in the office,” said Allen Tittle, co-founder of Tittle & Perlmuter law firm. “You have to invest in creating a paperless office. We scan in every piece of paper so we don’t have physical files to work on. Communication with your staff has to remain the same. We use a software called Slack, which is an instant-messaging software. We also video chat via Zoom, so that employees can still see each other. Finally, in terms of clients, we take advantage of video-chat software. We also use software that allows e-signatures on documents."

7.Communicate as Much as Possible

"The most important thing to do during this time of social distancing is to keep communication with your clients," said Alejandro Fiol, managing partner of the Fiol Law Group . "If you have an email list, send an update on how your business will continue conducting operations while keeping the health and safety of customers and employees in mind. In this time of uncertainty, it is important to reassure your clients that your business is taking the necessary precautions to keep everyone safe."

8. Focus on Strategies That Work in Crisis Atmosphere

"Shifting those dollars into what is working can be a game changer. For a law firm, we have stopped all print and Billboard ads and shifted those dollars back into the general budget while also allocating dollars to Facebook,” said Justin Lovely, managing attorney at the Lovely Law Firm . “Everyone will be at home doing two things — watching TV and scrolling through Facebook and other social media. Small businesses need to save their money while at the same time using the advertising budget they do have on marketing that has a high likelihood of success during this virus.” See: 8 Ways Your Bank Can Help You During Coronavirus Outbreak

9. Strategize Which Expenses to Pay and Which to Defer

“From a financial perspective, the best thing that small business owners can do now is to hoard cash. Do this by not spending unnecessarily. Make a list of all your expenses based on the last three months and analyze what your business can live without,” said Deltrease Hart-Anderson, CEO of D. Hart Accounting . “Ask for mortgage and/or bank lenders as well as utility companies to defer payment. In almost all economic downturns, the groups are bailed out by the government. Continue to pay your smaller vendors. Remember they are small businesses as well so they are going to be in the same boat you are. Keep essential employees as long as possible. This is also a great time to evaluate performances. You want to show your loyalty to your best employees in hopes they will return the loyalty should things get worse. Last but certainly not least, if you owe tax debt, now it the perfect time to renegotiate your current arrangement or make an arrangement with the IRS or state.” Up Next: 25 Small Business Grants

10. Modify Your Marketing — Don’t Cut It

“Do not cut your marketing budget, if at all possible. If you do your marketing in-house, redefine messaging and outlets to align better with current conditions. If you work with marketing contractors, talk with them about your shifting needs, and find a way to continue to work together,” said Julie Bee, founder of BeeSmart Social Media . “It's much harder (and more expensive) to start from scratch and try to regain market share than it is to maintain and slowly grow what you have — keep that in mind as you decide how to adjust marketing strategies.” More From Seek

- 4 Habits to Get Your Business Approved for More Financing

- Which Credit Cards Can Help Build Business Credit?

- 6 Best Payroll Services for Small Businesses

- How to Write a Job Description

Business Loan Resources

Photo credit: Monkey Business Images/Shutterstock.com